This year was a pivotal one for healthcare with nearly half of Medicare Advantage plans trying to rebound from significant Star Ratings declines.1

It was also marked by ongoing challenges: inflation, rising healthcare costs, staffing shortages, and razor-thin profit margins—to name a few.

The industry saw a greater emphasis on health equity, behavioral health, home health, and the member experience—trends that will continue to gain traction in 2024. Industry stakeholders have also recognized that solving for healthcare’s biggest challenges is no longer about who will win the race, but how we can come together to leverage partnerships that will improve the health of our populations.

From predictive analytics and remote monitoring to new ways to engage members, here are 5 healthcare trends taking shape in 2024.

Trend #1: Health Equity Will Take Centerstage

In the U.S., health inequities account for about $320 billion in annual health care spending, and if left unaddressed, could reach $1 trillion by 2040.2

While health equity has been on the radar for quite some time, in 2024 we expect to see a renewed focus.

Payors will continue to leverage partners that can deliver care navigation solutions and help members not only find care, but connect with community resources that can help address SDoH gaps such as food insecurity, transportation, health literacy, and financial hardship. For those living in rural, underserved areas, investments in virtual care platforms will also enable improved access.

With the CMS Framework for Health Equity, collecting and tracking demographic and SDoH data will also continue to be important to ensure access, deliver quality care, and close care gaps.

Payors, therefore, will increasingly look to solutions that are powered by predictive analytics and use Artificial Intelligence (AI) and machine learning (ML) to streamline member data collection and targeted resource allocation.

Through these technologies, payors can effectively anticipate and address unmet medical and social needs, understand members’ language and cultural preferences, and engage with them at the right time.

Trend #2: Expanded Behavioral Health Options

Individuals with behavioral health and physical conditions drive nearly 57% of all healthcare spending.3 Research suggests hospitalized patients who also have a behavioral health comorbidity have nearly double the readmission rate of patients without a comorbid behavioral health condition.4

As the U.S. continues to grapple with the mental health crisis, access remains an issue. In fact, more than half (54%) of adults with a mental illness do not receive treatment.5

In the new year, we expect more payors to continue to incorporate behavioral health and substance use disorder (SUD) benefits and expand their provider networks, including those for post-acute care. Most are already making the benefits reimbursable or building them out as a supplemental benefit in an effort to attract and retain new members.

The behavioral and brain health industry may also see greater integration of digital health technologies, diagnostics and therapeutics (DTx) that allow members to remotely detect, monitor, and manage changes in mood, cognition and sleep.

Additionally, multi-layer engagement platforms will continue to provide virtual caregivers or companions who can engage with older adults in their homes and combat social isolation and loneliness.

These tools will enable longitudinal care, drive member engagement, and provide critical data for providers and payors.

Trend #3: Demand for Health at Home Will Continue to Grow

The move to home health has been at play for several years and industry stakeholders agree it’s a trend that will continue on the upswing. According to a CareCentrix survey, 97% of health plan executives say more care at home is better for insurers and members.6

Delivering care in the home can be linked to better outcomes, lower costs, and optimal member experiences. In 2024, not only do we expect more post-acute care to move into the home, but we’ll see a seismic shift to:

- hospital-at-home

- skilled nursing facility (SNF)-at-home

- home infusion therapy

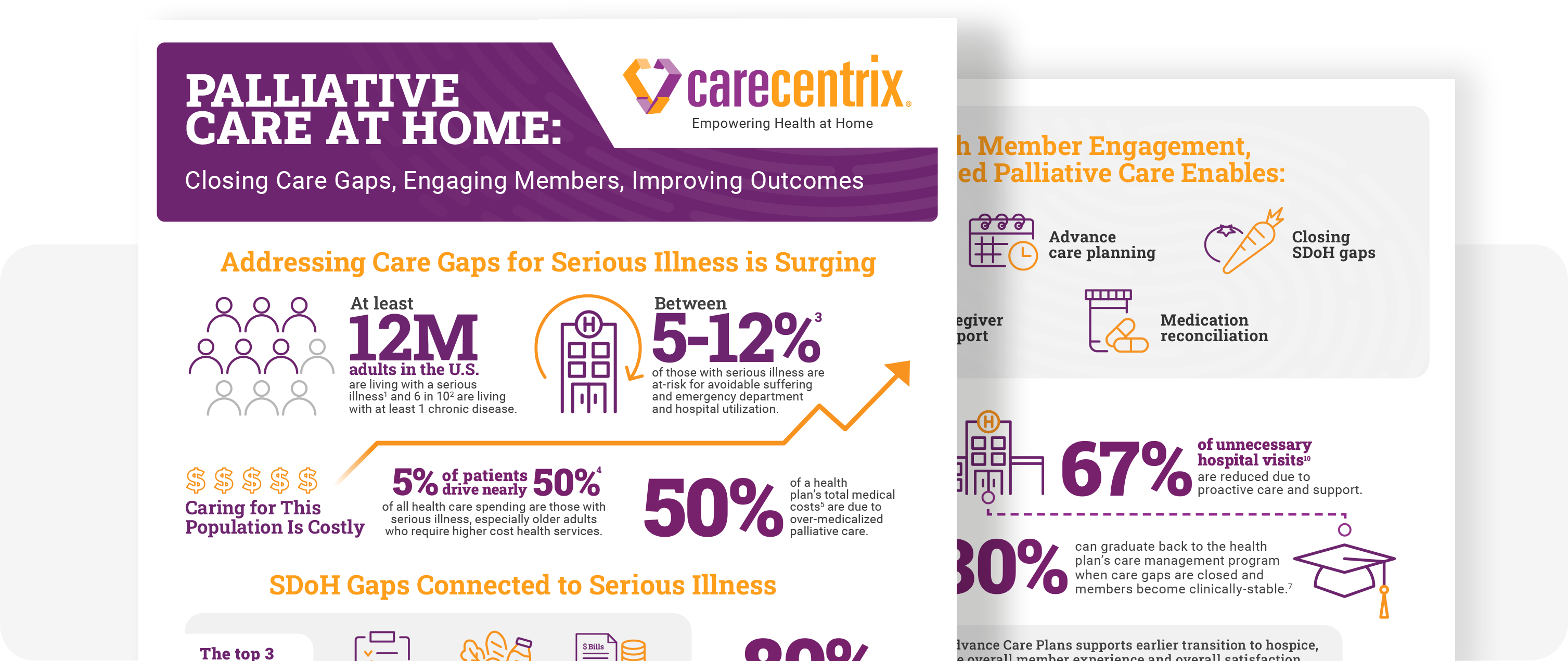

- home-based palliative support

We anticipate payors will make investments in solutions that combine telehealth and remote patient monitoring (RPM), enabling care to be more longitudinal rather than episodic. This approach will also allow providers to easily monitor what is happening with their patients at home. The key, however, will be to look for partners that have networks that provide quality, whole-person care and high-tech, high-touch, personalized care.

Trend #4: New Ways To Engage Members In Primary Care

Primary care can be critical to ensure members get preventative screenings, manage chronic conditions, prevent issues before they arise, and lower the total cost of care.

Primary care is also important for those who are released from the hospital or a skilled nursing facility (SNF). Research shows that people who follow up with their physicians within seven days of discharge have a significantly lower risk of readmission.7 Unfortunately, however, 100 million people in the U.S. don’t have a primary care provider (PCP).8

In the new year, payors will increase their efforts around member engagement strategies to drive primary care utilization. For example, through partnerships, members will be engaged in their homes or in the community at local pharmacies and connect to primary care physicians.

Higher member engagement rates may help payors realize better outcomes and lower costs.

Trend #5: Strategic Partnerships and Increased Collaboration

Healthcare organizations are recognizing their limitations to solve the challenges plaguing the industry today. As a result, investments in partnerships that improve the quality of care for their members are rapidly expanding.

In 2024, payors will not only leverage partnerships but will prioritize vendors that can integrate into their current solutions.

For example, we could see transportation companies partner with home health solutions and local pharmacies to help members easily get their prescriptions, DME supplies, and health and personal care items. We’ll also see vendors that can provide care navigation and address SDoH needs at the same time.

There’s no doubt that with increased collaboration across the industry and innovative investments, we’ll see a marked improvement on access, outcomes, and costs—and a better member experience at every touch point along the journey.

Learn more about trends impacting home health.

Sources:

- “Medicare Advantage star ratings show steep declines for 2023 as pandemic flexibilities go away.” Fierce Healthcare, 2022.

- “US healthcare can’t afford health inequities,” Deloitte, 2022.

- “How do individuals with behavioral health conditions contribute to physical and total healthcare spending?” Milliman, 2020.

- “Behavioral Health Comorbidities Linked with Higher Hospital Readmission Rates.” Chia, 2020.

- Access to Care Rankings. Mental Health America, 2023.

- Health at Home Report. CareCentrix, 2020.

- “Follow-up Post-discharge and Readmission Disparities Among Medicare Fee-for-Service Beneficiaries.” National Library of Medicine, 2022.

- “Closing the Primary Care Gap.” National Association of Community Health Centers, 2023

EDRC: 2053