4 Healthcare Trends that MA Plans Should Know in 2023

4 Healthcare Trends that MA Plans Should Know in 2023

This year will be one marked by significant change and challenges as Medicare Advantage (MA) plans grapple with their new Star Ratings. In fact, only 51% of Medicare Advantage plans1 offered this year achieved a Star Rating of 4.0 or better, a sharp drop from 68% in 2022.2 What healthcare trends can MA Plans anticipate this year?

Over half of an MA Plan’s Star Rating will be composed of CAHPS® which doubled to a weight of four in 2023. And with more proposed changes this year, it is clear that CMS will continue to put a high focus on outcomes and overall member experience.

We believe the path to increasing your Star Rating for 2024 is by focusing on member experience and CAHPS, addressing health inequity, improving quality of care and outcomes, and delivering on quality, whole-person care.

Here, we explore four healthcare trends taking shape that will affect MA plans this year and beyond, and why health at home has emerged as the common denominator.

1. A Greater Emphasis on Social Determinants of Health (SDoH) Data to Improve Health Equity

Health inequities account for approximately $320 billion in annual healthcare spending, and, if left unaddressed, the cost could reach $1 trillion or more by 2040, a report by Deloitte found.3

In recent years, efforts to advance health equity have been a key area of focus industry-wide.

For Medicare Advantage, in particular, payors that have a home-first focus can find success in better understanding the patient outside the clinical setting and leveraging data and analytics to identify and address non-clinical needs such as:

- food insecurity

- housing

- transportation

- social isolation and loneliness

- household needs

However, identifying SDoH only scratches the surface. In 2023, MA plans with engagement practices that incorporate cultural competency can help overcome health inequities that many members face. By understanding differences, and by breaking down language and cultural barriers, plans can improve engagement with their members, which improves access to care and drives adherence and better outcomes.

Strategies that integrate care, compassion, and support with machine-learning tools to continuously learn and evolve provide an improved way to identify the necessary social drivers and interventions to focus on to remove barriers for members.

2. Telehealth and RPM Expansion

Reducing unnecessary hospital readmissions continues to be a key challenge for MA plans.

Up to 20% of Medicare beneficiaries are re-admitted to the hospital within 30 days of discharge and 76% of readmissions are potentially avoidable—driving up to $12 billion in healthcare expenditures4

Telehealth and remote patient monitoring (RPM) are two technologies that have been utilized by healthcare organizations to improve access and quality, close care gaps, increase patient engagement, and reduce re-admissions—and interest continues to grow.

In fact, one study found 60% of C-suite executives, clinical leaders, and healthcare professionals think RPM will become the new standard of care over the next two years.5

Plus, the passage of the Omnibus Appropriations Bill6 and telehealth flexibilities extended through 2024 signal the need for—and value of—offering alternative avenues to ensure equitable care for the most vulnerable populations.

With the proposal that the all-cause readmissions metric be weighted more heavily, and interest in home-based solutions slated to grow this year, we expect to see an even bigger emphasis on these technologies in rural areas where there are gaps in access and quality, as well as in urban areas, where high population and traffic can often be a barrier to care.

We also anticipate a surge in the adoption of solutions for at-home diagnostics, preventive screenings, and sleep testing, as well as increased reimbursement for these services—improving access to care and member satisfaction.

3. A Shift to Home-Based Care Models for Members with Chronic and Serious Illness

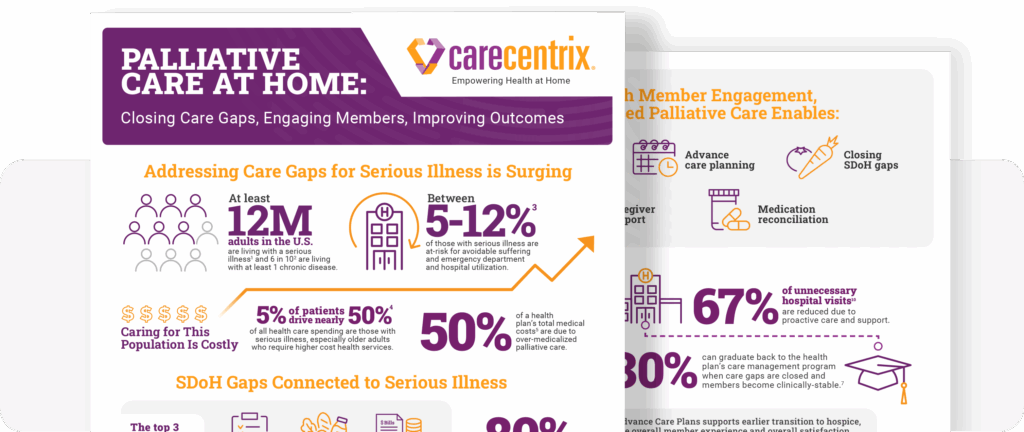

Health at home solutions show no signs of slowing down, but what will change this year is the emphasis to expand care, which broadens the reach of home-based care for members with more complex or serious illnesses, including palliative support and home infusion therapy.

MA plans should explore home-based approaches that can seamlessly integrate into their existing programs, allowing the member’s physician to continue leading the care plan, and promote coordination and collaboration of services with an extended care team to support the member in the home.

For palliative care, payors should look for solutions to reduce unnecessary emergency room visits, reduce stress, and improve the overall experience for members at all stages of serious illness, which include:

- identifying the unmet medical and social needs of members earlier in their diagnosis.

- having a supportive care team, including palliative-trained nurses and social workers, to engage with members and their caregivers at home to assist with advance care planning, reduce barriers to care, and connect to community resources.

Additionally, there’s been a significant interest in home infusion therapy, which is driven by the rapid pace of new treatments, expanded indications, and the rising cost of specialty medications.

When clinically appropriate, transitioning infusion therapy from hospitals to home is not only preferred by members for convenience and comfort, but because the home provides a more cost-effective way to receive treatment.

MA plans should look for a home infusion therapy solution that can optimize their current program, such as:

- a home infusion network that covers all its members, including rural neighborhoods

- step down approaches to optimal site of care

- provider engagement and coordination for transitions of care

Moving to home-based palliative care and home infusion leads to better management of members with more complex needs at home, driving better member experience, quality of care, and helping to manage therapy costs.

4. Community-Based Healthcare with Clinical in Retail Pharmacies Leading the Way

In 2023, MA plans should expect to see a greater focus on leveraging the surrounding community, such as local retail pharmacies with clinics, to optimize the delivery of care in the home.

According to a recent survey by Deloitte,7 only 10% of consumers have used a retail clinic within the past year, but 55% said they would be “likely to” or “maybe would” use them for preventive care and nearly half (47%) said the same for mental healthcare.

With nearly 9 in 10 Americans living within 5 miles of a community pharmacy8 it makes it easier for members to access the services they need. Leveraging local retail pharmacies not only offers convenience and access to cost-effective care, but can improve health equity by establishing access to primary care providers and pharmacists who are sensitive to the local culture of that community.

The combination of care delivered in retail and in the home fosters collaboration across the care continuum, and ensures the right care at the right time to improve outcomes, allowing MA plans to better manage risk and reduce the total cost of care.

Interested in optimizing your health at home strategy for 2024? Click here to learn about CareCentrix solutions.

Footnotes

1) Fact sheet 2023 Medicare Advantage and Part D Star Ratings. CMS. 2) Fact Sheet – 2022 Part C and D Star Ratings. CMS. 3) Davis, A., et.al. (2022) US health care can’t afford health inequities. Deloitte. 4) DRAFT Measure Specifications: Potentially Preventable Hospital Readmission Measures for Post-Acute Care. CMS. 5) From Reactive to Proactive: Strategies for Successful Remote Patient Monitoring Implementation and Adoption. WebCareHealth. 6) https://www.appropriations.senate.gov/imo/media/doc/JRQ121922.PDF 7) Read, L., et al. (2022) Advancing health through alternative sites of care. Deloitte. 8) Pharmacies – The Face of Neighborhood Healthcare Since Well Before the Pandemic. National Association of Chain Drug Stores (NACDS) Foundation.

(EDRC 1892)

Related Blog Posts

Cancer Care Reimagined: Delivering Immunotherapy at Home

In the United States, the population is growing and living…

Closing the Gap: How Timely Delivery of Home Health Care Drives Better Outcomes

The High Stakes of Post-Hospital Care The transition from hospital…

From Hospital to Home: The Unique Role of Nurse Liaisons

In celebration of National Nurses Month, we’re highlighting a couple…

Palliative Care at Home: Closing Gaps, Engaging Members

Supporting members with serious illness can become costly. The need…

Sleep Disorders: The Silent Epidemic Costing $94B Annually

Just like eating healthy, drinking enough water, and exercising, we…

Family Caregivers: How Palliative Care Can Help

Facing a serious illness is overwhelming for patients, their family…